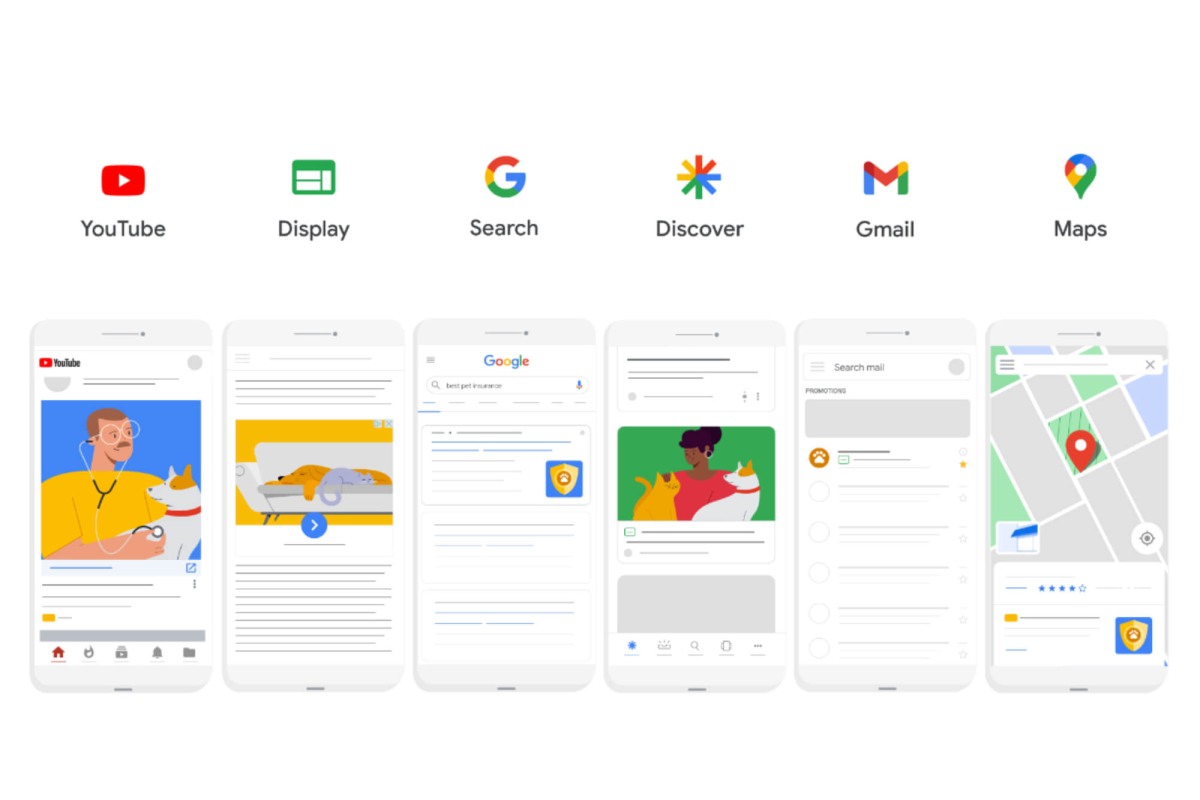

ICYMI: Google is rolling out a new campaign type called Performance Max that replaces Smart Shopping campaigns. Smart Shopping has been great from a channel diversification perspective, expanding your real estate from the Shopping tab across Google’s Display Network, YouTube and Gmail without having to set up specific campaigns across these verticals.

Performance Max builds on Smart Shopping by making available new inventory, including Dynamic Search Ads, Discovery Ads and YouTube Instream. Google likes PMAX so much that they’re forcing everyone to migrate over to these campaigns come July 1st – this means the time to test and learn is closing fast, and we have seen there is an element of learning from the machine’s side before ROAS returns to normal before starting to trend in the right direction.

Similar to Google Analytics 4’s event-based system, PMAX is touted as a goals-based, automated solution targeted at unlocking maximum performance comprised of the following three components:

- A single, goal-based campaign focused on achieving the performance objectives, leveraging automation and machine learning.

- Path-to-purchase aware, ensuring the right ad served at the right time in line with your marketing objectives.

- Access to the best inventory across Google properties to reach customers where they are, efficiently and at scale.

Are you ready to move from Smart Shopping to Performance Max?

Performance Max is about to be adopted by all eCommerce spenders, and the window of first-mover advantage and test and learn is closing rapidly. Act now. LION Digital’s Search specialists can support you throughout your transition to PMAX and other adaptive ad technologies.

We recently achieved outstanding results for our client Helly Hansen!

To know more check our case study.

Work with leaders in the eCommerce space to transform your channel strategy.

LION stands for Leaders In Our Niche. We pride ourselves on being true specialists in each eCommerce Marketing Channel. LION Digital has a team of certified experts and the head of the department with 10+ years of experience in eCommerce and SEM. We follow a ROI-focused approach in paid search backed by seamless coordination and detailed reporting, thus helping our clients meet their goals.

GET IN CONTACT TODAY AND LET OUR TEAM OF ECOMMERCE SPECIALISTS SET YOU ON THE ROAD TO ACHIEVING ELITE DIGITAL EXPERIENCES AND GROWTH

Contact Us

Leonidas Comino – Founder & CEO

Leo is a, Deloitte award winning and Forbes published digital business builder with over a decade of success in the industry working with market-leading brands.

Like what we do? Come work with us